author

Lígia Carvalho

It’s official: on July 4, 2025, U.S. President Donald Trump signed into law the One Big, Beautiful Bill Act, one of the most comprehensive tax reforms in recent decades. Among its highlights are structural and permanent changes to the Low-Income Housing Tax Credit (LIHTC) program—the main federal incentive for affordable housing in the country.

This enactment marks a historic milestone for the affordable housing sector, with the potential to significantly expand the scale and predictability of housing projects targeting low-income populations. For impact-driven investors and long-term-focused managers, such as CIX Capital with the CIX ESG Affordable Housing Bond II, the new regulations indicate an increasingly favorable environment for the growth of this strategy.

The LIHTC is the U.S. government’s primary tool to encourage the private sector to build and preserve affordable housing for low-income families.

Created in 1986 as part of the Tax Reform Act, the LIHTC emerged during a shift in U.S. housing policy, following decades of declining direct federal subsidies.

In the 1940s and 1950s, programs like FHA 608 supported housing construction for veterans. In the 1960s, initiatives like HUD 236 provided subsidies and low-interest loans to private developers. However, with the pullback of direct federal housing investment in the 1980s, a new model was needed—one that mobilized private capital. The LIHTC filled this role by offering tax credits to investors who financed affordable housing developments.

Through these incentives, the program has attracted substantial private investment, resulting in the development and preservation of millions of affordable units nationwide. To date, LIHTC has financed over 3.7 million homes and accounts for roughly 90% of all new affordable rental housing production in the U.S.

The program is federally administered by the Internal Revenue Service (IRS) but distributed at the state level through annual allocations to Housing Finance Agencies (HFAs), which select qualifying projects via competitive processes.

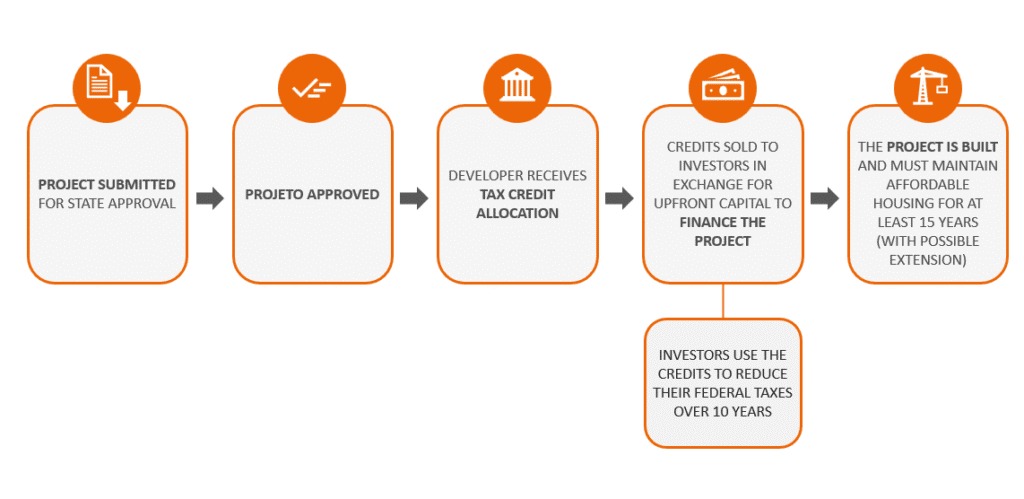

The LIHTC currently operates through two primary credit types:

● 9% Credit: Targets developments without tax-exempt bond financing; covers up to 70% of qualified costs.

● 4% Credit: Requires that at least 50% of project costs be financed by tax-exempt Private Activity Bonds (PABs). This is known as the “50% test.”

Each U.S. state has an annual cap on the amount of PABs it can issue, based on population. High-demand states like California often hit this cap quickly, due to competition from infrastructure, education, health, and housing projects.

As a result, viable and socially impactful developments were often unable to secure sufficient bond financing to meet the 50% threshold and were thus disqualified from receiving the 4% LIHTC.

In addition, smaller-scale projects or those with blended funding (e.g., municipal or philanthropic) frequently did not require 50% bond financing—but still lost eligibility, despite being economically viable.

This structural constraint prevented many states and municipalities from accelerating affordable housing pipelines, even with land and projects ready to go.

4% Credit Financing Mechanism

Eligibility Rules for Tenants

To qualify for LIHTC-supported units, developments must meet one of two criteria:

● At least 40% of units must be rented to families earning ≤ 60% of Area Median Income (AMI), or

● At least 20% of units must go to families earning ≤ 50% of AMI.

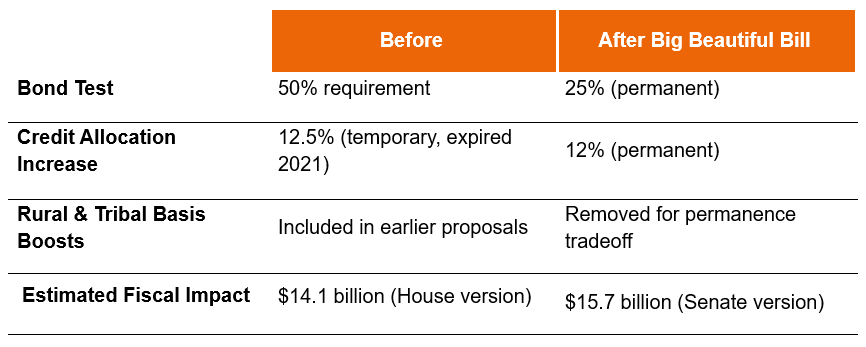

The annual LIHTC allocation per state is limited, which restricts the number of projects that can be financed. Previous temporary increases, like the 12.5% expansion from 2018 to 2021, have expired—leaving uncertainty for developers and investors.

To expand the effectiveness and scale of the LIHTC, the U.S. Senate introduced the One Big, Beautiful Bill Act in June 2025 as part of its tax reform package.

The name is a nod to a phrase frequently used by President Trump to describe bold, politically charged legislation. The bill reflects a bipartisan effort to address the nation’s housing affordability crisis through long-term solutions.

Signed into law on July 4, 2025, after a narrow 51–50 Senate vote (with Vice President J.D. Vance casting the tie-breaking vote), the act introduces the following key changes:

According to consulting firm Novogradac, these changes are expected to enable the development of over 1 million additional affordable units over the next decade.

The reforms provide long-term predictability, remove technical bottlenecks for socially necessary projects, and unlock pipelines in states previously constrained by the 50% rule.

By reducing the bond requirement to 25%, states can finance twice as many developments with the same bond volume. This change especially benefits urban markets with high land and construction costs, where demand for affordable housing is acute.

For institutional investors—particularly those with ESG or impact mandates—this creates an environment that strengthens the economic and social case for investing in affordable housing.

The enactment of the Big Beautiful Bill represents the most significant structural advance in the LIHTC program in nearly 20 years. Set to take effect on January 1, 2026, the reforms are expected to drive tangible, long-term expansion of the affordable housing sector, stimulate economic activity, and provide a powerful response to the housing affordability crisis in the U.S.

As highlighted by Affordable Housing Finance magazine in its July 2025 issue, these updates mark: “The biggest expansion of the program in decades.”

In short, the affordable housing sector is undergoing a historic shift—and investment vehicles well-positioned to capture this moment, like the CIX ESG Affordable Housing Bond II, have a rare opportunity to deliver measurable social impact and attractive financial returns at scale.

● Novogradac. (2025). Final Reconciliation Bill Permanently Expands LIHTC, NMTC and OZ Incentive. https://www.novoco.com/notes-from-novogradac/final-reconciliation-bill-permanently-expands-lihtc-nmtc-and-oz-incentive-but-does-not-include-htc-provisions

● Nelson Mullins. (2025). Senate Passes Reconciliation Bill with Historic Housing Credit Investment. https://www.nelsonmullins.com/insights/alerts/nelson-mullins-affordable-housing-news/all/senate-passes-reconciliation-bill-with-historic-housing-credit-investment-what-is-next

● Housing Finance Online. (2025). LIHTC Provisions Become Permanent in Senate Reconciliation Bill. https://www.housingonline.com/2025/06/18/lihtc-provisions-become-permanent-in-senate-reconciliation-bill/

● Tax Credit Coalition. (2025). Senate Provides Permanent Housing Credit Expansion, Lower Bond Test in Reconciliation Bill. https://www.taxcreditcoalition.org/senate-provides-permanent-housing-credit-expansion-lower-bond-test-in-reconciliation-bill/

● Politico. (2025). Vance’s Potential 2028 Democratic Rivals Want Him to Be the Face of the Megabill. https://www.politico.com/news/2025/07/01/vance-one-big-beautiful-bill-2028-00436041

● CRE Daily. (2025). LIHTC Reform Gains Momentum with Proposed Federal Bill. https://www.credaily.com/briefs/lihtc-reform-gains-momentum-with-proposed-federal-bill/

● McGuireWoods. (2025). Congress Passes One Big Beautiful Bill Act With Impacts on Housing. https://www.mcguirewoods.com/client-resources/alerts/2025/7/congress-passes-one-big-beautiful-bill-act-with-impacts-on-housing/

CIX Capital is an investment by Maiz: maiz.com.br